Paying an independent contractor is simpler than paying an employee– there’s no payroll tax, no paid vacation, and benefits aren’t required. Sounds great, right? Well, it’s a little more complicated than that. So many new businesses have fallen into the trap of hiring employees then treating them like contractors for tax purposes. Don’t let this be you. It could cost you more in legal fees and taxes than you’d ever save in the first place.

So, how do you know the difference? Simply put, an independent contractor is self-employed and can determine how and when they work. An employee is employed by you and you have a level of control over how and when they work.

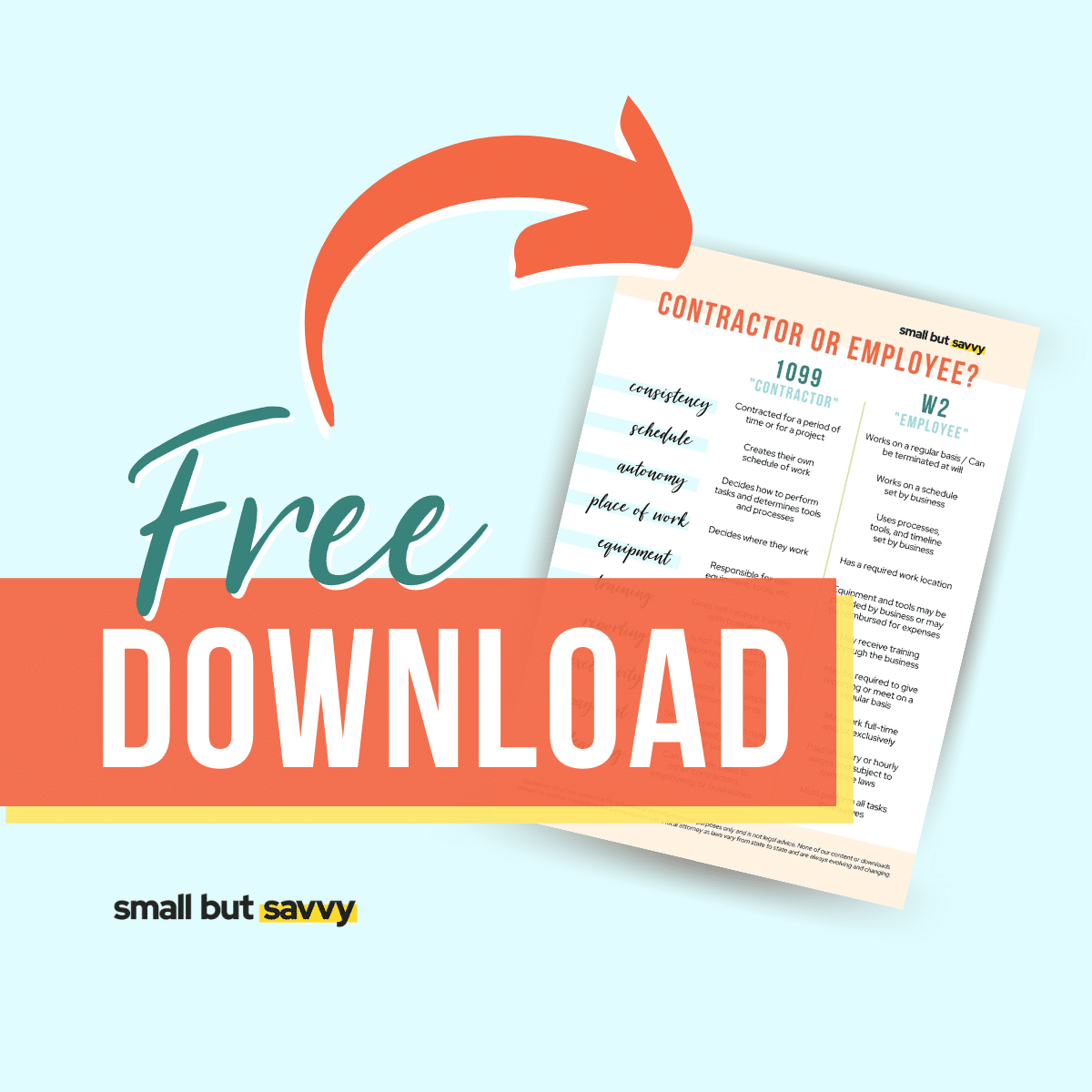

Download our simple chart to see if you should be sending a 1099 or W2 tax form to your team member.